Types Of Retirement Plans Chart

If youre new to the financial industry you might be wondering what your options are when it comes to retirement.

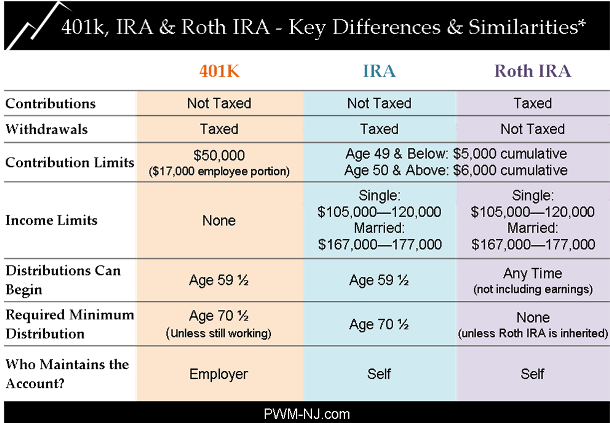

Types of retirement plans chart. With a regular IRA you pay income taxes on the money. Read on to learn about the best retirement plans out there. 401k When you think of retirement plans the first thing that comes to mind is probably a 401k.

A 401 k plan is a workplace retirement account thats offered as an employee savings plan benefit. 2021 Retirement Plan Comparison Chart. Latest Stock Picks.

An IRA is a tax-favored retirement account that lets you contribute a certain amount each year and invest your contributions tax deferred. 6 Types of Retirement Plans You Should Know About. From that starting point we can look at the different types of plans available and design a plan that is attractive to both employers and employees.

Any employer who has less than 100 employees. TYPES OF RETIREMENT PLANS. We accomplish that goal by putting our money into many different types of retirement plans.

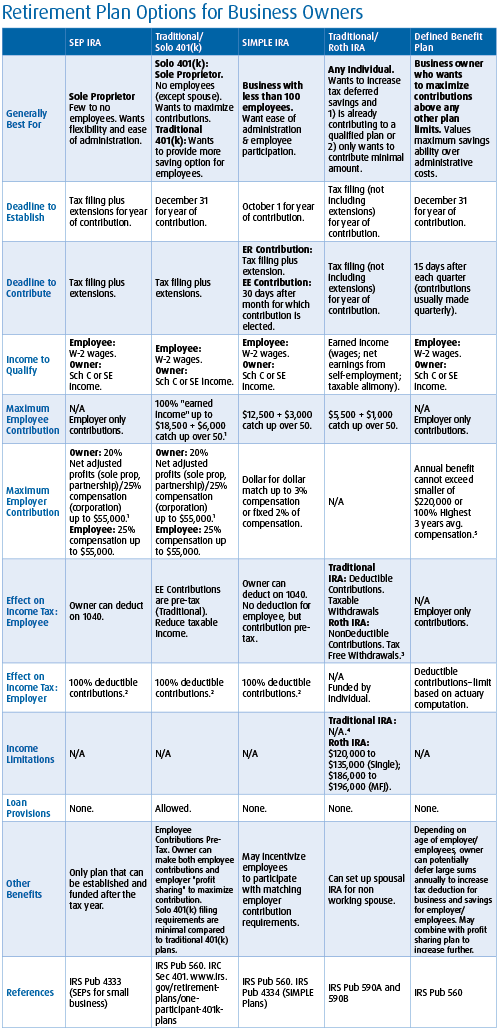

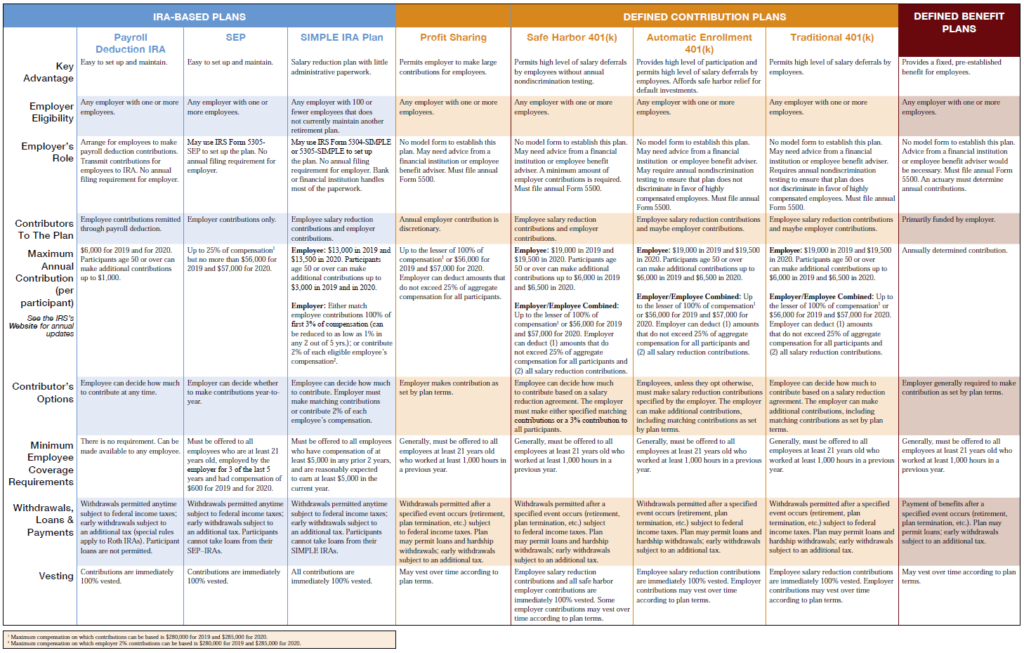

Individual Retirement Account IRA. The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company. SIMPLE 401 k Plans.

The 457f plan is less commonly used. The plan may state this promised benefit as an exact dollar amount such as 100 per month at retirement. Savings Incentive Match Plan for Employees Simplified Employee Pension.

Rule Breakers High-growth stocks. 17 rows Exide Life Golden years Retirement Plan. 6 rows 2020 RETIREMENT PLAN COMPARISONS Deined Contribution Plans Plan Type SEP-IRA SIMPLE-IRA.

Defined benefit plans and defined contribution plans. The 457b plan is the most commonly used one. Safe Harbor 401 k Plans.

This account allows you to. This comes with a high rate of interest at over eight percent. PPF scheme is another option for those interested in opting for a safe retirement planning.

One of these is the Monthly Income Scheme MIS. Stock Advisor Flagship service. Types of 457 Plans.

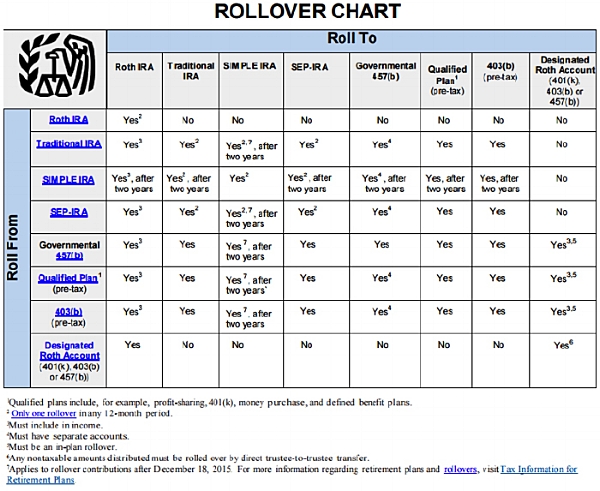

NoteThis chart represents highlights of retirement plans only. When should distributions begin. 2 Advantages of Having a Retirement Plan By starting a retirement savings plan youll help your employees save for the future and youll help secure your own retirement.

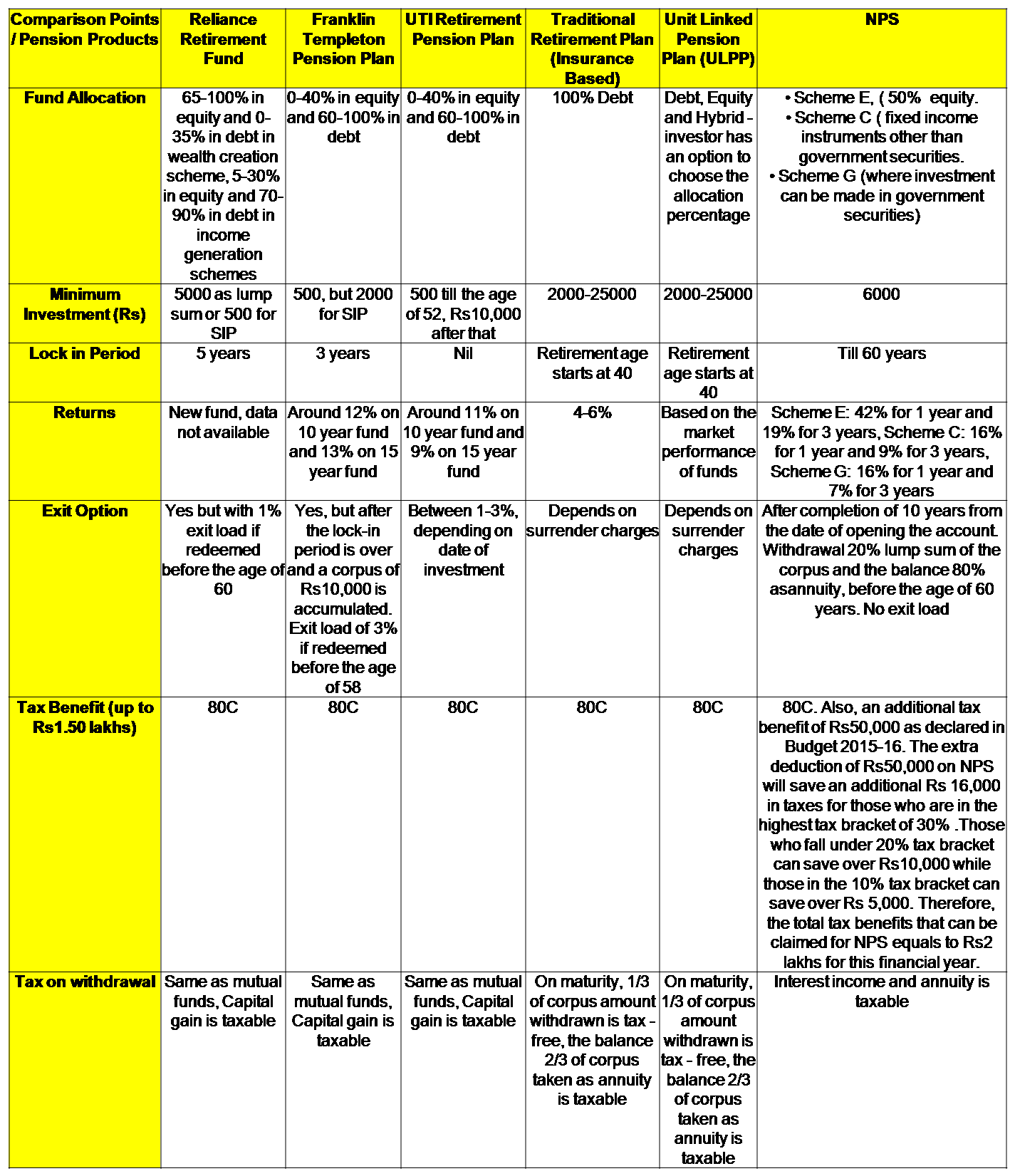

Their features differ on the basis of the subscribers payout needs annuity or lump sum insurance requirements insurance-based or non-insurance based the timing of payout deferred benefit or immediate annuity expected returns and risk appetite ULIPs or government-sponsored. A defined benefit plan promises a specified monthly benefit at retirement. SIMPLE IRA Plans Savings Incentive Match Plans for Employees SEP Plans Simplified Employee Pension SARSEP Plans Salary Reduction Simplified Employee Pension Payroll Deduction IRAs.

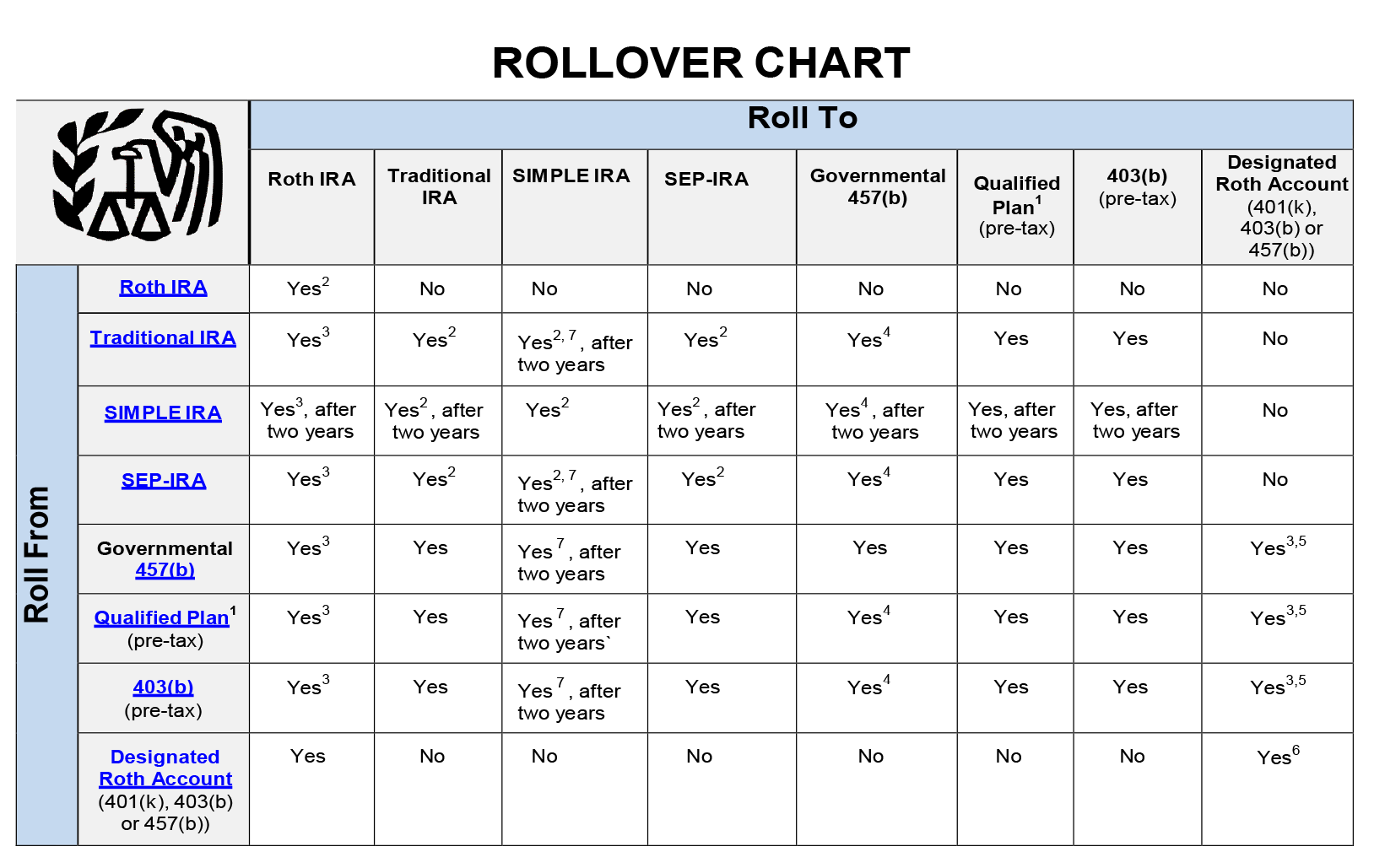

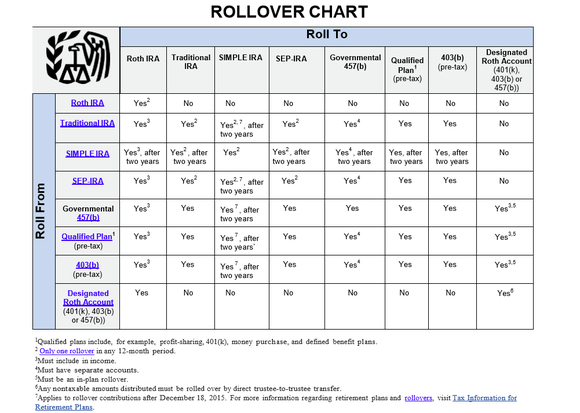

The plan is made available to employees who work for the state or local government. SIMPLE IRA 401k 401k Safe Harbor Formula SEP Profit Sharing Money Purchase Pension Eligible Employers. 9 rows This chart provides quick details for each of the main types of employee retirement.

A 401k is a. Individual Retirement Arrangements IRAs Roth IRAs. Highlights of eight types of retirement plans.

Individual Retirement Accounts IRAs SIMPLE IRA. Use our guide to understand which retirement plan is best for you. Plan Feature Comparison Chart a Retirement Plan.

There are different types of retirement plans available in the market today. Click on the PDF link in the green box below. The Employee Retirement Income Security Act ERISA covers two types of retirement plans.

That means you pay no taxes on annual investment gains which helps them to grow more quickly. With so many types of retirement plans out there finding the right one for you might be confusing.

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)