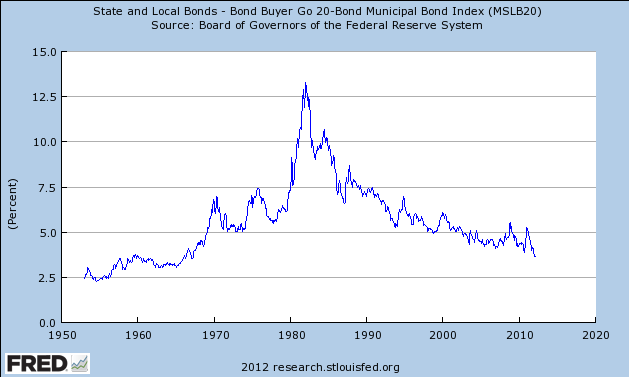

Municipal Bond Rates Chart

The 20-Bond GO Index is based on an average of certain general obligation municipal bonds maturing in 20 years and having an average rating equivalent of Moodys Aa2 and Standard Poors AA.

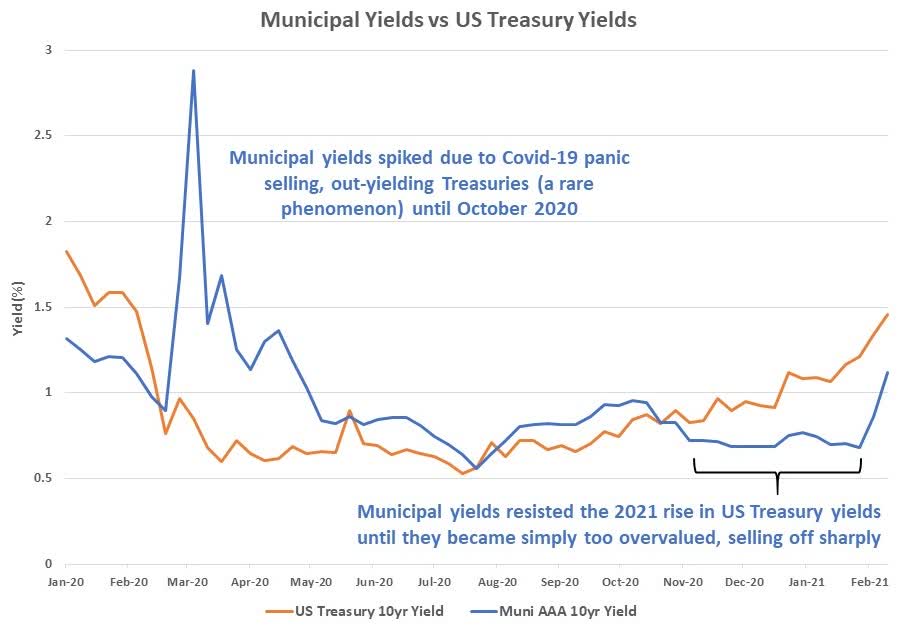

Municipal bond rates chart. These rates reflect the approximate yield to maturity that an investor can earn in todays tax-free municipal bond market as of 12182021. With respect to interest-rate risk you can see that muni bonds do about as well as the broader bond market. Depending on maturity call credit that 5 bond may have a.

Four of the graphs are based on The Bond Buyer 20-Bond GO Index. Pretty nice in a 100 150 interest rate world. Seeking Value in High Yield Munis.

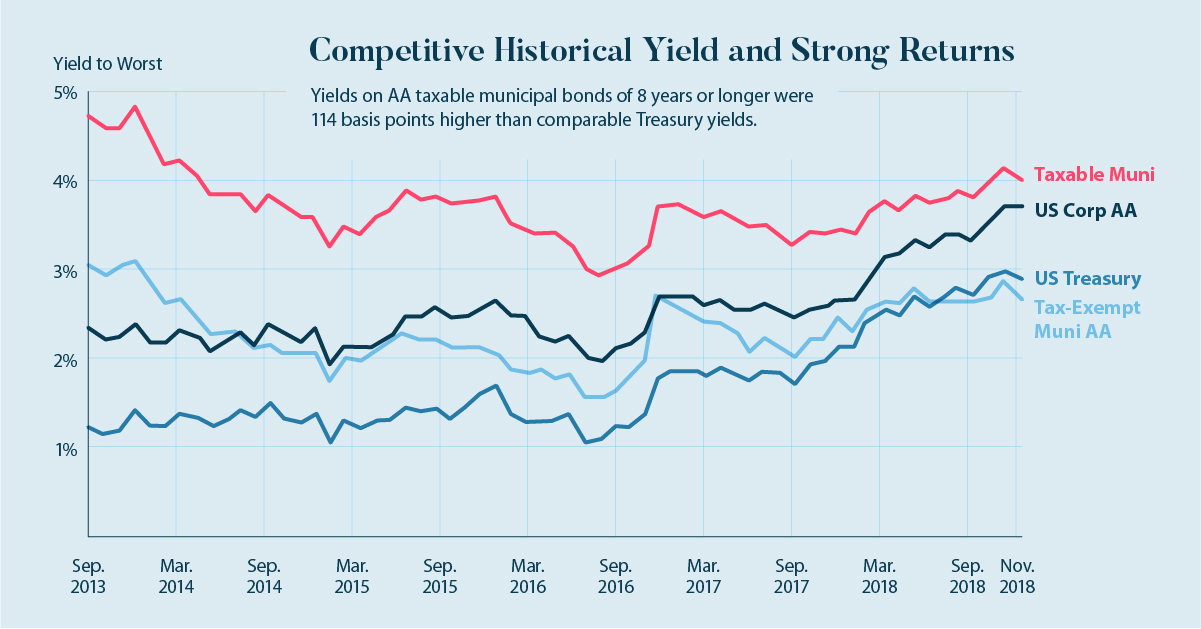

As illustrated in the chart below this rate is currently 471 meaning if an investors combined tax rate federal state local and other applicable taxes is above 475 munis yield more than corporate bonds after taxes. Municipal Market Yields. Data as of March 22 2019.

Closing index values return on investment and yields paid to investors compared with 52-week highs and lows for different types of bonds. Heres the chart from Blackrock. The SP Municipal Bond Index is a broad market value-weighted index that seeks to measure the performance of the US.

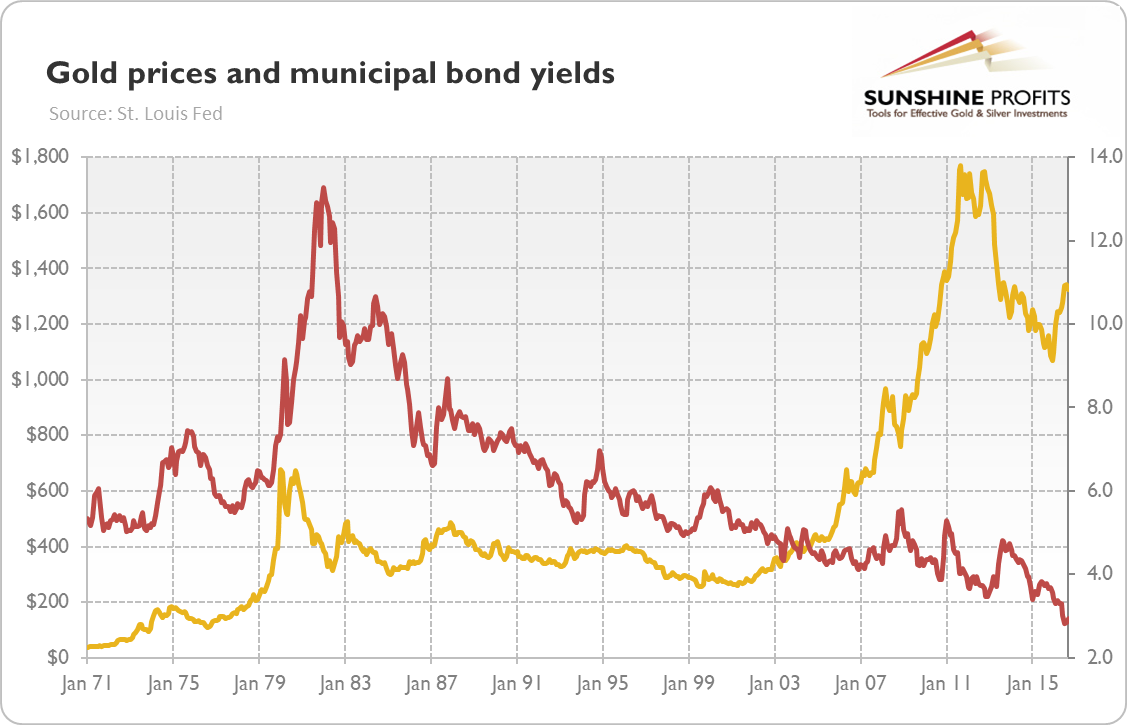

Graph and download economic data for Yields on Municipal Bonds Twenty Bond Average for United States M13050USM156NNBR from Jan 1948 to Jan 1967 about bonds yield interest rate interest rate and USA. MMDThe Thomson Reuters Municipal Market Data AAA Curve. The Market Yield data noted above is the average posted yield.

India 10 Year Government Bond Yeld increased to a 20-month high of 646 the highest since April of 2020 following hawkish monetary policy decisions by the Bank of England and the US Federal Reserve as they warned of surging inflation. What is Municipal Bond Rates Chart. In addition to continuous charts the collection includes thousands of single-contract historical price charts that cover individual contract months from years past.

Bonds Interest Rates A listing of bonds and interest rates which are updated daily. Eligible bonds must be rated at least AA by Standard and Poors Ratings Services Aa2 by Moodys or AA by Fitch. At the same time on the domestic front signs of slowing growth rising cases of the Omicron variant and a higher than expected rise in.

High Yield Muni-Bond Spreads ex-Puerto Rico Recently Reached the Widest Level in Five Years Data for the period June 1 2015April 30 2020. Which is why when you buy individual bonds we are required to show you the yield to worst on your bond right up front before purchasing. Municipals finished with a negative return in all three.

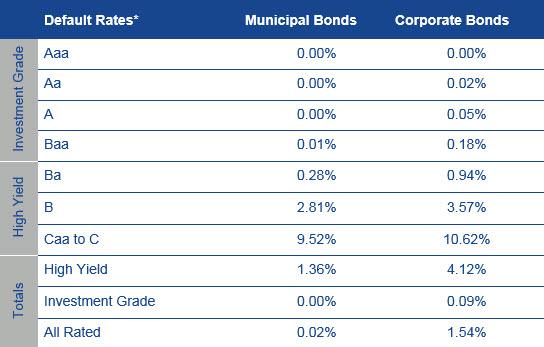

The average recovery rate on defaulted municipal bonds has been 66 of par compared to 42 of par for. MSFT - Microsoft Corp. Municipal Bond Insights and Charts.

If there are multiple ratings the lowest rating is used. These rates are broken down to AAA AA and A where applicable and give approximate yields to maturity that an investor can earn in todays tax-free municipal bond market. Data as of April 30 2020.

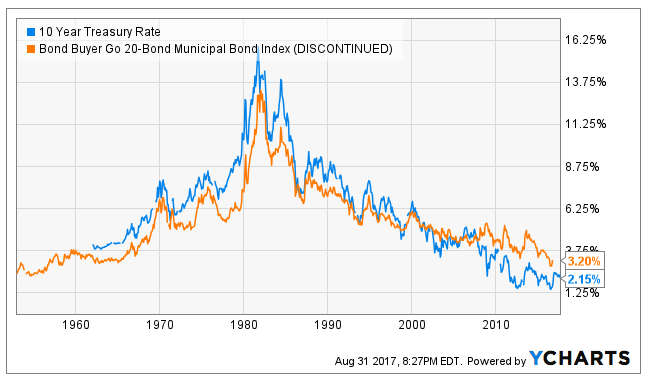

Treasuries Data as of March 22 2019. In the three years when the Barclays Aggregate Index lost ground 1994 1999 and 2013 rates rose in two of those years. Historically the Switzerland Government Bond 10Y reached an all time high of 5.

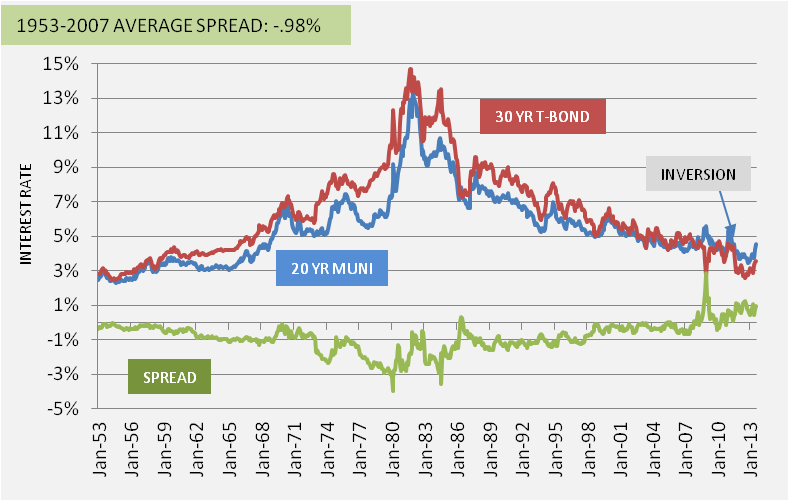

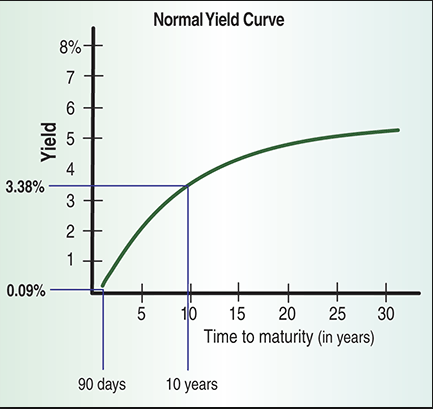

44 in March of 1985. For example at a 28 marginal tax rate if a municipal bond earned 2 that would be a tax-equivialent yield of 21-028 278. The following graphs set forth information relating to municipal bond yields interest rates trends.

The tables and charts below provide yield rates for AAA AA and A rated municipal bonds in 10 20 and 30 year maturity ranges. State and local government need low-cost muni bonds to finance improvements in infrastructure. Chart derived from the Bloomberg.

Thomson Reuters MMD and Bloomberg. Find information on government bonds yields muni bonds and interest rates in the USA. Municipal Bond Interest-Rate Risk.

The 1 5 and 10-year cumulative default rates for all Moodys-rated municipal bond issuers have been 00043 00233 and 00420 respectively compared to 00000 01237 and 06750 for Aaa-rated corporate bonds during the same time period. A Steeper Yield Curve than US. The breakeven tax rate is the tax rate at which a municipal bond will yield more than a corporate bond before adjusting for taxes.

This continuous historical price chart for Muni Bond Index ECBOT futures ZU CBOT is part of a huge collection of historical charts that covers decades of North America futures commodity trading. The SP Municipal Bond 20 Year High Grade Rate Index consists of bonds in the SP Municipal Bond Index with a maturity of 20 years. Reduced purchases of longer-dated muni bonds after the tax rate was lowered from 35 to 21 under the 2017 tax bill.

04 of your portfolio which I bet is a far smaller cost than you expected. On the other hand munis had a positive. The chart below shows CDs corporate and municipal bond yields daily from one to over 20 years where applicable.

Premium coupon muni bond and the premium price is 12500 then you have a 400 current yield.